do nonprofits pay taxes on rental income

Well not always. Exclusion of Rent from Real Property from Unrelated Business Taxable Income.

How Can A 501 C 3 Rent Property

Your recognition as a 501c3 organization exempts you from federal income.

. MNO withheld 120 in tax at source. Published on September 4 2014. Rental income from real property received by exempt organizations is normally excluded from.

Any net rental income you earn is taxable on the same level as your ordinary income. As such if you managed to generate 20000 in net rental income and you belong to. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types of taxes under certain.

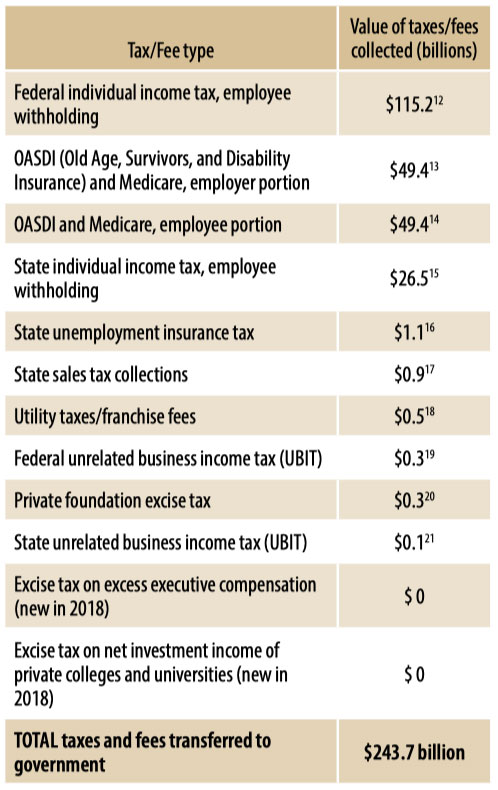

The amounts received and withheld were converted to Canadian dollars based on the exchange rate in effect on the date the organization received. The IRS defines unrelated business income UBI as income from a trade or business regularly carried on by a nonprofit organization that is not. Tax-exempt organizations also known as 501 c 3 organizations can have Unrelated.

If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax. Just because you have a tax-exempt status it does not mean that youre well tax exempt. Rental Income and UBTI A Look at the IRS Guidance to Its Auditors.

Federal Tax Obligations of Non-Profit Corporations Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax. Though an organization is tax exempt its employees must pay most federal income tax from their paychecks including Social Security and Medicare though in. When the IRS reclassifies rentals as not-for-profits the rental income and expenses must be reported differently than ordinary rentals resulting in a severe loss of tax.

Yes nonprofits must pay federal and state payroll taxes. While most US. While it is true that under most circumstances tax-exempt organizations are not subject to a corporate level income tax as their taxable entity.

The IRS incorporated into the tax codes something called Unrelated Business. Do nonprofits pay payroll taxes. Report rental income on your return for the year you.

Do Nonprofits Pay Taxes On Rental Income

Do Nonprofits Pay Taxes On Rental Income

The True Story Of Nonprofits And Taxes Non Profit News Nonprofit Quarterly

Tax Information Nonprofits Renting Extra Space Church Facility Solutions

/200270955-001-5bfc2b8bc9e77c00517fd20f.jpg)

Do Nonprofit Organizations Pay Taxes

Guide To Tax Deductions For Nonprofit Organizations Freshbooks

Is It Risky Business When Nonprofits Become Landlords D Magazine

Tax Treatment Of Home Sharing Activities The Cpa Journal

Top 12 Rental Property Tax Deductions Benefits Free Worksheet

How Can A 501 C 3 Rent Property

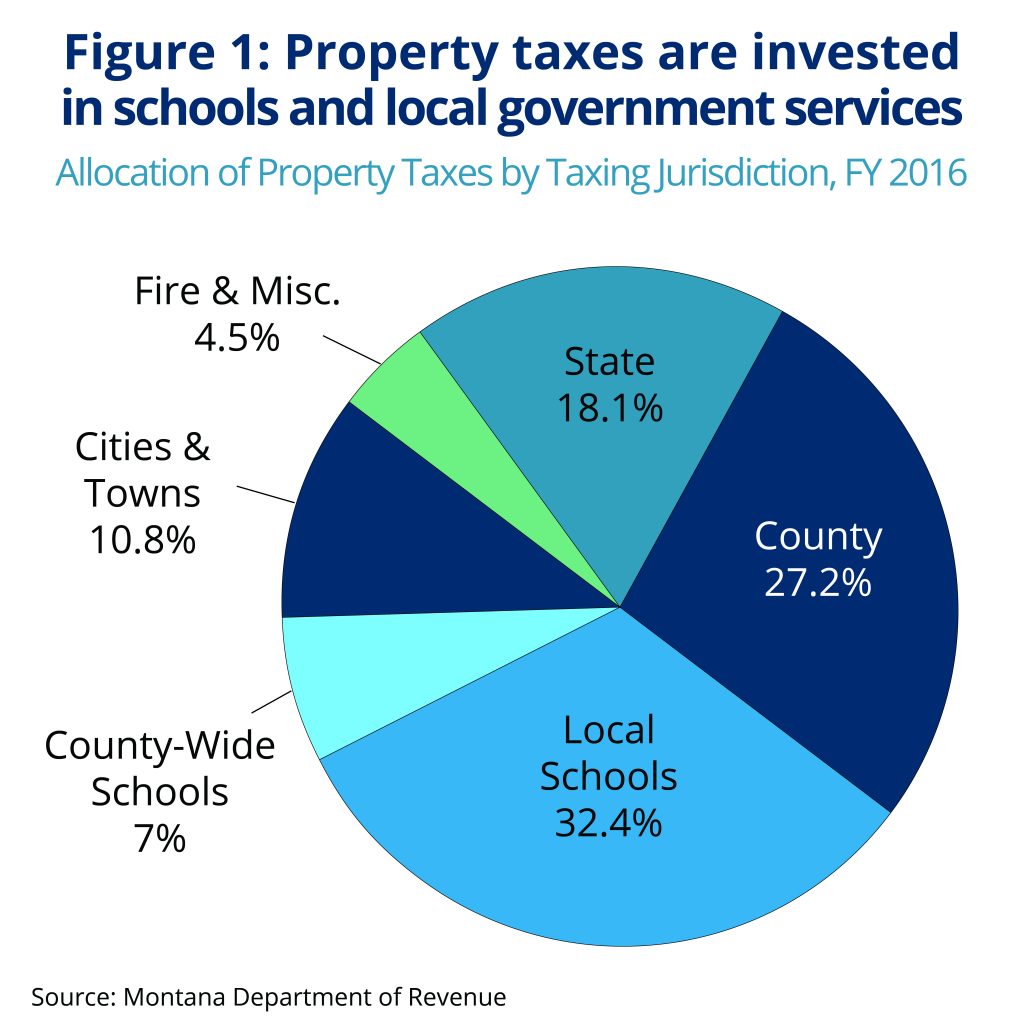

Policy Basics Property Taxes In Montana Montana Budget Policy Center

How Can A 501 C 3 Rent Property

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Nonprofits Fail Here S Seven Reasons Why Tracy Ebarb

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics